Rapid rent hikes threaten viability of small shops across Addis Ababa

By Yared Seyoum

Beyenech Getahun was working behind the counter of her small store located in the Sheger Grandmall shopping complex in Addis Gebeya. Business had been slow that morning as customers were few and far between. She stared blankly at the shelves stocked with various snacks, drinks and small household items, worrying about how she would make ends meet with another rent increase looming.

Just a month ago, her landlord had come to inform her that her monthly rent for the 12 square meter kiosk space would be going up by 5000 birr, from 15,000 birr to 20,000 birr. Beyenech struggled to process the news, knowing full well her small snack and goods business did not generate enough income to sustain such a steep hike. "I really wanted to vacate as I cannot sustain my business with this rent but as I would lose my customers, I had to accept and pay what is asked," she lamented.

Beyenech had rented the kiosk space for over five years, building up a steady customer base in the area with her friendly service and convenient location. But now, she worried if she would be able to hold on much longer with commercial rents eating up more and more of her profits. As a sole proprietor supporting her family, every birr counted and an additional 5000 birr per month was a huge burden. What's more, her landlord had hinted this may not be the last increase and prices could go even higher in the coming years.

She wasn't the only small business owner struggling under the weight of accelerating rent hikes. Across Addis Ababa, stories similar to Beyenech's had become all too common as commercial property rents continued their rapid upward climb, leaving many traders and entrepreneurs questioning how long they could endure the growing financial strain.

Martha Seyoum was experiencing the same predicament running her small clothing store in the bustling Merkato area. Her nine square meter shop space now required 18,000 birr in rent each month, up from 15,000 birr the previous year. "Rents around here have really ballooned. I've heard other shops in the area are paying as high as 25,000 birr now for a space similar in size to mine," she commented with a worried expression. Like Beyenech, Martha wondered how long she could shoulder higher operating costs before being forced to close down, after investing years building her business from scratch.

In Kolfe Keranio, Ayat, last name withheld upon request, managed a small liquor store occupying 30 square meters. Only three months ago, his monthly rent was 18,000 birr but it had recently been increased to 22,000 birr. The additional costs were taking a visible toll on his operations. "To try and cut back expenses, I've had to let go of one employee who helped out part-time in the store. Now it's just myself running the place single-handedly. As a result, it's much more difficult to keep things organized and serve customers efficiently," he explained.

"With rising rents, I'm barely breaking even these days. If this continues, I don't know how long I’ll be able to stay in business," Ayat concluded worriedly.

Economist specialized in retail trade Amanuel Mengitu was all too familiar with the factors driving the rapid surge in commercial rents plaguing the city. "The property tax imposed on rental income from commercial properties has been increasing dramatically over the past few years per the directives of tax authorities," he began. "I know of a shopkeeper whose annual tax on a rented store jumped from just 5,000 birr to a staggering 38,000 birr virtually overnight!"

Previously, rental rates between landlords and tenants were negotiated based on a mutual agreement. But now, Amanuel noted that tax assessments were primarily pegged to prevailing market rates instead of historical rental contracts. "This new valuation policy has put immense pressure on landlords to frequently increase rents on tenants in order to cover their ballooning tax obligations. Ultimately, the extra costs get passed down to small entrepreneurs in the form of higher monthly rent bills."

Beyond skyrocketing property taxes, Amanuel pointed out several other market irregularities exacerbating the rental crunch. "It has become common practice that if a new tenant wants to take over an existing store space, they often have to pay the current occupant a fee basically to vacate the premises. Brokers call this 'key money', on top of the monthly rent owed to the landlord. This practice of double payments has further inflated rental values across the board."

Addisu Gessesse had spent the past decade as a commercial property broker operating out of the busy Merkato area. In his view, the proliferation of unscrupulous brokers was partly to blame for soaring rents. "Many brokers make unreasonable promises to landlords, pressuring them to hike rents on existing tenants in hopes of getting a 'better deal' to re-let the space. Even if there are no new prospective tenants willing to pay more, this mentality of always seeking higher prices has driven values up artificially," he argued.

In addition to speculators, Addisu acknowledged more legitimate economic factors were at play as well. "Inflation eating into incomes and rising operational costs have impacted tenants' willingness and ability to pay higher rents. On the demand side, there is always someone willing to meet asking prices no matter how unreasonable because of the critical shortage of available commercial properties. Overall, tenants have very weak bargaining power which is exploited."

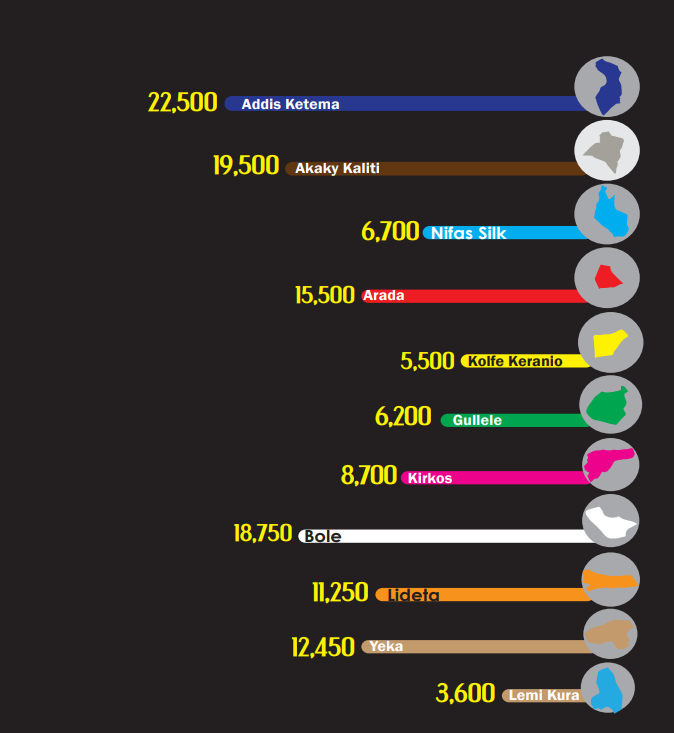

To get a clearer picture of the current rental landscape across the capital, surveys of major commercial centers have shed light on pricing trends from different subcities. The market survery, which was conducted by BirrMetrics last month, analyized sampled monthly rental rates per square meter in major shopping complexes and business districts.

To get a clearer picture of the current rental landscape across the capital, surveys of major commercial centers have shed light on pricing trends from different subcities. The market survery, which was conducted by BirrMetrics last month, analyized sampled monthly rental rates per square meter in major shopping complexes and business districts.

According to the survey, popular commercial nodes like Addis Ketema, Bole, Lideta and Yeka command the highest rents, with per square meter prices exceeding 10,000 birr on average. Meanwhile, emerging districts farther out like Gulele, Kolfe and Lemi Kura still have relatively lower rates under 7,000 birr/sqm. However, even these 'cheaper' locations have witnessed double-digit percentage rent hikes annually.

The data shows Addis Ketema commanding the highest monthly rental rates of all subcities surveyed, averaging 22,500 Birr per square meter. Situated in the heart of the capital, Addis Ketema is a premier commercial district and home to Merkato, the largest open market in Ethiopia.

At an average rate of 3,600 Birr/sqm, Lemi Kura rental prices are the most affordable according to the market research. This emerging eastern subcity is still developing its commercial infrastructure compared to longer-established areas. Property values tend to be lower given Lemi Kura's relative newness and distance from Addis Ababa's core business districts.

Beyond the figures, to better understand what's driving the rental boom, it is important to examine both demand and supply side factors at play in Addis Ababa's property market. On the demand front, Ethiopia's economy has posted impressive average GDP growth of almost eight percent in the last five years. Rapid urbanization and population growth in the capital have led to an expanding consumer base and thriving small business environment supporting brisk demand for commercial real estate.

At the same time, the supply of available retail and office spaces has failed to keep pace. Strict regulations limiting land transfers and property development have constrained new construction activity. The limited stock has thus been unable to absorb heavy competition from growing numbers of entrepreneurs and investors seeking prime storefront locations. This acute supply-demand imbalance has naturally pushed prices higher in a textbook case of simple economics.

However, policy decisions have arguably exacerbated the mismatch. The tax law introduced this year indexing valuations to market prices rather than historical contracts as the economist highlighted, has unintentionally incentivized frequent rent hikes from landlords. Meanwhile, speculative activities like 'key money' fees have further distorted pricing without adding any tangible new inventory to the market.

However, policy decisions have arguably exacerbated the mismatch. The tax law introduced this year indexing valuations to market prices rather than historical contracts as the economist highlighted, has unintentionally incentivized frequent rent hikes from landlords. Meanwhile, speculative activities like 'key money' fees have further distorted pricing without adding any tangible new inventory to the market.

Caught in the middle are small business owners like Beyenech, Martha and Ayat who have little choice but to bear the brunt of escalating rental costs. While some well-capitalized larger businesses may be able to absorb higher occupancy expenses, many individual traders and entrepreneurs operating on thinner margins struggle with each incremental rate increase. The cumulative effects threaten the livelihoods of those who have invested years building their enterprises.

Shops that shutter due to unsustainable rents also do not bode well for the overall commercial property sector. Yet with underlying supply and demand dynamics showing no signs of correcting significantly in the near future, the commercial rental boom looks poised to continue. Small businesses now find themselves in a daily fight for survival against stronger economic currents. Only the most resilient will endure being swept along by rising tides of rent. Whether policies can be adjusted to buffer the impacts on vital local enterprises remains to be seen. But for now, the high costs of doing business in the capital show no signs of abating.